Tapping into the Low-Carbon Real Estate Market

Image from Pexels

This article is based on a paper by Leaders of the Urban Future (LOTUF) in partnership with Systemiq

This article is based on a paper by Leaders of the Urban Future (LOTUF) in partnership with Systemiq

Executive Summary: Creating a Market for Low-Carbon Real Estate

Decarbonising our global economy necessitates decarbonising real estate. Beyond this imperative, decarbonised buildings offer enhanced energy and cost efficiency, attractiveness to climate-conscious tenants, and reduced risk against future climate regulations. Despite the evidence of a growing market for holistically “green” certified buildings, there is not yet a meaningful market for low-carbon (i.e. 1.5°C-aligned) real estate. Achieving deep decarbonisation of buildings requires substantial investment — $600 billion annually until 2050. Regulatory action is essential to unlock this market, but progress has been slow.

In the near term, the drive for low-carbon buildings must come from a clear demand signal from lenders, tenants, investors (LPs), and fund managers (GPs), reflected in third-party valuations. These stakeholders need robust infrastructure, including voluntary standards, pathways, certifications, and data, to identify, price, and demand low-carbon buildings.

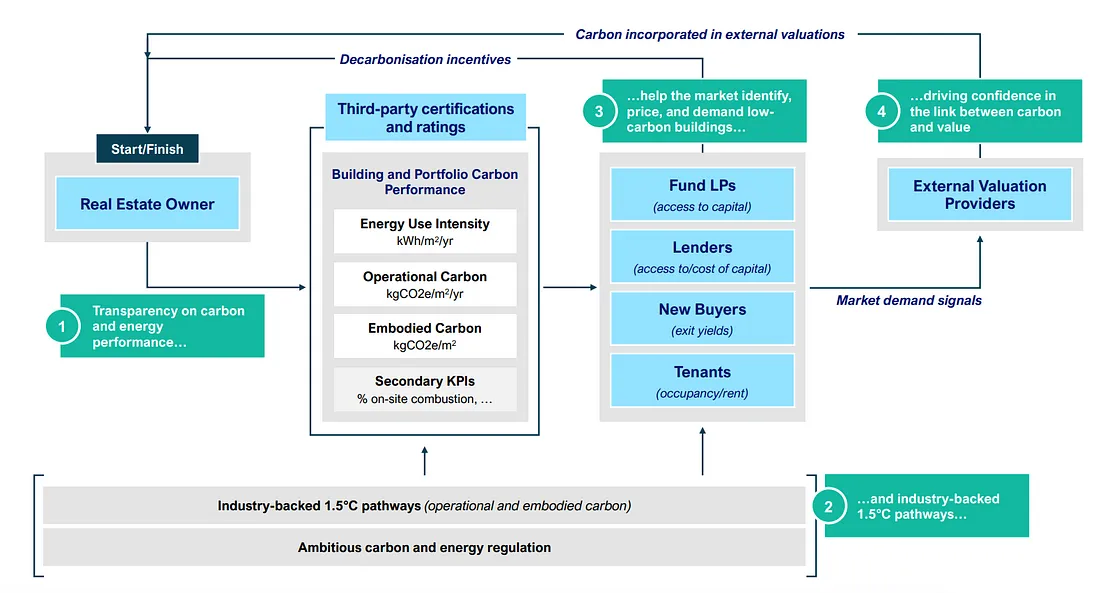

Low-carbon real estate requirements for a well functioning market

1. Carbon and Energy Performance Transparency

Stakeholders must assess buildings and portfolios using real data and consistent carbon and energy metrics (energy use intensity, operational carbon, embodied carbon).

2. Clear Targets

Industry-accepted targets should indicate expected performance, comparing against a common set of 1.5°C pathways using shared decarbonisation principles.

Third-party certifications and ratings, currently used to assess carbon performance, can enhance transparency and highlight 1.5°C-aligned buildings and portfolios.

With these elements, stakeholders can better identify and price low-carbon buildings, giving valuers the evidence needed to incorporate carbon considerations into their models. This will boost confidence among real estate owners to transition their building stock, eventually leading to performance-based regulations consistent with voluntary standards and 1.5°C pathways.

However, two main challenges hinder this market development:

1. Lack of Clarity in Current Tools:

Many major certifications and ratings do not provide comprehensive insights into energy use intensity, operational carbon, and embodied carbon KPIs. They also lack targets aligned with 1.5°C pathways, resulting in many certified assets not meeting these standards.

2. Inconsistent Correlation with Energy Performance:

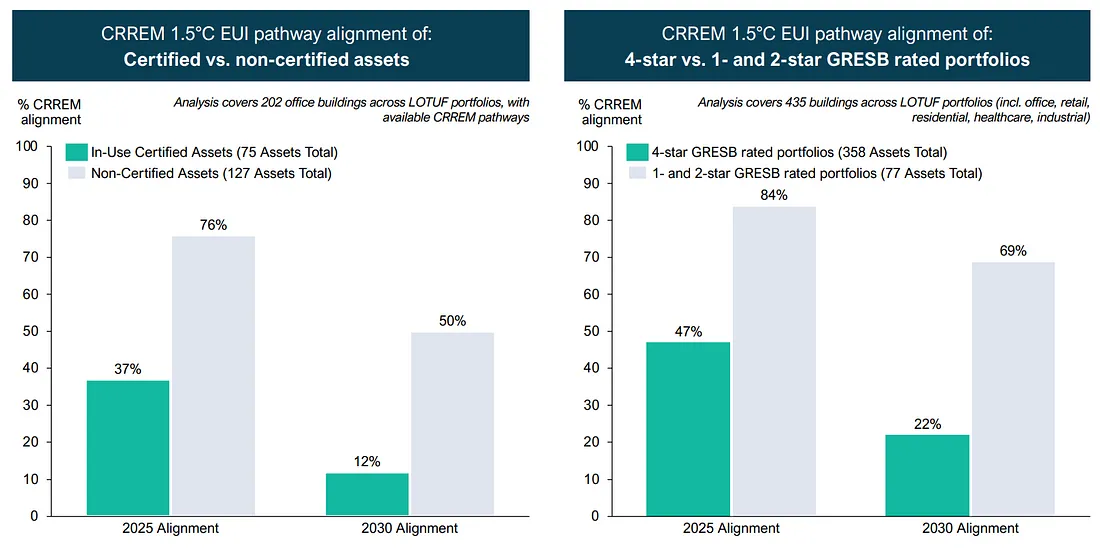

Analysis shows only 37% of certified assets across Leaders of the Urban Future investor portfolios aligned with Carbon Risk Real Estate Monitor (CRREM) 1.5°C energy intensity pathways by 2025, with no clear correlation between certification and better energy performance.

Refinement of existing 1.5°C pathways is needed, and while they should not dictate all certification targets due to building-level complexities, they should inform market decision-making and target-setting.

Transparency on carbon and energy performance of buildings, and commonly agreed 1.5°C pathways are key to unlocking the low-carbon real estate market — illustration by Leaders of the Urban Future (LOTUF) in partnership with Systemiq

Analysis shows that the major certifications, which account for over 80% (or 9 billion m2) of the certified floorspace globally, do not currently offer transparency about energy and carbon performance. They also lack specific goals that are in line with the 1.5°C routes.

As a result, any demand signal is muted since lenders, tenants, investors, and fund managers seeking low-carbon buildings are having difficulty finding, pricing, and offering incentives for them — either to reduce the risk to their business or as a value proposition.

External valuation providers are unconfident about including a price for carbon in their evaluations. This implies that it is now very difficult to establish a direct relationship between value and carbon, which reduces market confidence to fund significant decarbonization.

To be clear, this divergence has nothing to do with ratings or certifications. They react to what the market demands. End users who are concerned about carbon are actively demanding 1.5°C alignment and transparency on carbon performance due to shifting market demand.

Driving Demand for Low-Carbon Real Estate

Certifications and ratings are not the root cause of the disconnect in the market for low-carbon real estate; they respond to market demand. For change, end-users must actively demand transparency on carbon performance and 1.5°C alignment.

Progress requires action from all stakeholders. To kick-start the low-carbon real estate market, the following are needed:

Stakeholder Demand

Lenders, tenants, investors, and fund managers should demand transparency on carbon and energy performance from market participants and the certifications and ratings they use. Assessments should be based on common metrics, decarbonisation principles, and 1.5°C pathways.

Enhanced Certifications and Ratings

Certifications and ratings must enable better assessments by providing transparency on their targets, ensuring these targets are informed by 1.5°C pathways, and publicly reporting on the carbon and energy performance of rated buildings and portfolios.

Standard Setters and Pathway Developers

Alignment around a commonly agreed set of 1.5°C pathways is needed to inform target setting, building on and improving existing pathways. This requires a multi-stakeholder effort involving standards, pathway developers, certifications, ratings, and key industry bodies such as Green Building Councils.

Third-Party Valuers

Valuers must incorporate carbon into their assessments, working closely with building owners and lenders to understand assumptions on carbon and value, and supporting evidence, to help facilitate an emerging demand signal.

Policymakers

Policymakers should amplify market signals by introducing ambitious performance-based regulations that drive transparency and data-sharing, with clear targets for energy use intensity, operational carbon, and embodied carbon. These should align with the standards and pathways supporting the voluntary market.

Real estate owners can play a pivotal role in accelerating change by:

1. Demonstrating to lenders, tenants, and other investors the importance of demanding low-carbon buildings or at least clear carbon and energy performance data.

2. Utilizing certifications and ratings that provide transparency and reflect 1.5°C ambition.

3. Facilitating transparency by gathering and sharing carbon and energy performance data and demanding this data during transactions.

4. Advocating for simple, ambitious, performance-based regulation with clear carbon and energy targets.

This call for greater carbon and energy transparency is echoed by other investor initiatives such as GREEN and the Better Buildings Partnership (BBP).

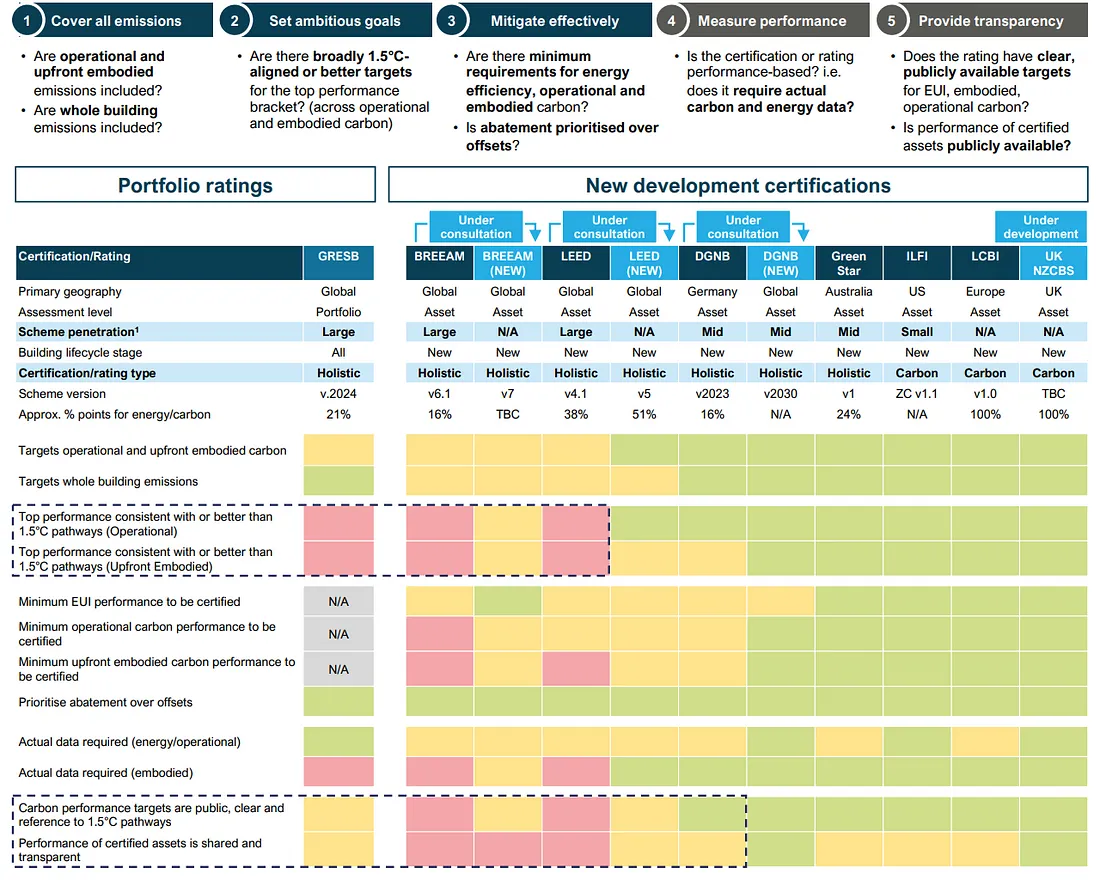

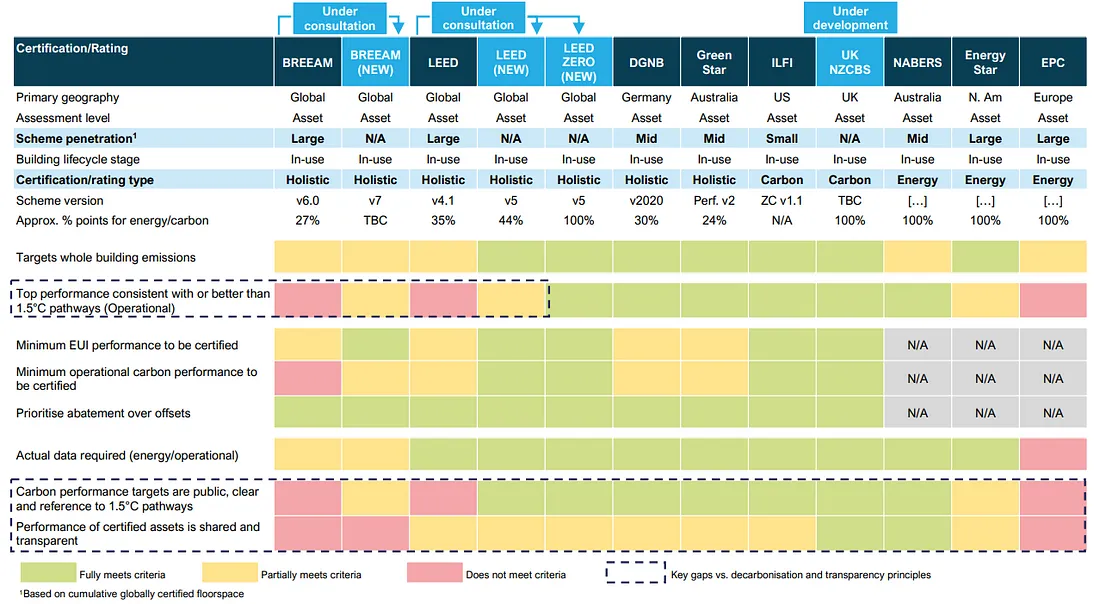

Tools and Framework for Low-Carbon Real Estate Assessment

To support stakeholders in consistently assessing carbon and energy performance, this paper presents a simple due diligence framework compatible with existing tools. Additionally, Exhibit 3 offers a detailed mapping of certifications and ratings, aiding owners in identifying schemes that provide transparency and have targets aligned with 1.5°C pathways (or are progressing towards this goal).

Methodology for comparison of certifications/ratings vs decarbonisation & transparency principles

Enhibit 3: Systemiq analysis supported by Arup.

Enhibit 3: Systemiq analysis supported by Arup. This was conducted based on available certification documents, external input, and stakeholder discussions. The complexity and variability of approaches across different schemes makes it challenging to assess all of them in a consistent like-for-like manner. There is therefore some degree of subjectivity in these assessments

In recent months, LOTUF has actively engaged with major certifications and ratings to enhance the transparency and ambition of their targets. These efforts, along with broader industry announcements, indicate positive market momentum. Notably, major certifications such as LEED and BREEAM are updating their schemes for greater transparency and ambition, and new carbon-focused schemes are emerging. Efforts to improve CRREM 1.5°C pathways and boost uptake through increased industry participation in governance and technical work are ongoing. Furthermore, RICS recently published guidance on how external valuers can incorporate carbon and energy considerations into their assessments. This progress is encouraging, but significant work remains to align the sector with 1.5°C targets.

Enhanced transparency in carbon and energy performance and commonly agreed 1.5°C pathways are crucial for establishing a clearer link between carbon and value, thereby unlocking the low-carbon real estate market. The risks and opportunities for real estate are well-known — nearly 20% of current real estate value is at risk from the transition if no action is taken. Conversely, there is growing evidence, including among the LOTUF group, that decarbonisation can create and preserve value. To demonstrate this at scale and initiate the low-carbon real estate market, real estate owners and other market participants must shift from relying on opaque tools to embracing real carbon performance transparency and 1.5°C targets.

An emerging toolkit of data and pathways exists to facilitate this shift. While these data and pathways require ongoing improvement, they provide a solid starting point to accelerate change today.

Key points include:

1. Due Diligence Framework

A framework is provided to help assess carbon/energy performance with existing tools. 2050 Materials platform is the perfect tool that provides the necessary data to help developers build projects with sustainability features. Find out more about 2050 Materials here.

2. Certification and Rating Mapping

Exhibit 3 helps identify schemes offering transparency and targets aligned with 1.5°C pathways.

3. Market Momentum

Major certifications like LEED and BREEAM are enhancing transparency and ambition; new schemes and improvements to CRREM 1.5°C pathways are underway.

4. Valuer Guidance

RICS has published guidance on incorporating carbon and energy into valuations.

5. Market Risk and Opportunity

Nearly 20% of real estate value is at risk without action; decarbonisation has shown to create and preserve value.

6. Action Required

Shift from opaque tools to transparent carbon performance and 1.5°C targets, using an emerging toolkit of data and pathways.

To unlock the low-carbon real estate market, stakeholders must demand and utilize transparent carbon performance data and align with 1.5°C pathways. Progress has been made, but continuous improvement and active participation from all market players are essential to accelerate this transition.

There are some exceptions. For instance, NABERS, an energy rating system used in the UK and Australia, includes transparent energy and carbon data for all rated assets in addition to having explicit, performance-based targets. Other ambitious programs are the US’s ILFI, Europe’s LCBI, and the soon-to-be UK NZCBS. However, this is not how most certified buildings are represented.

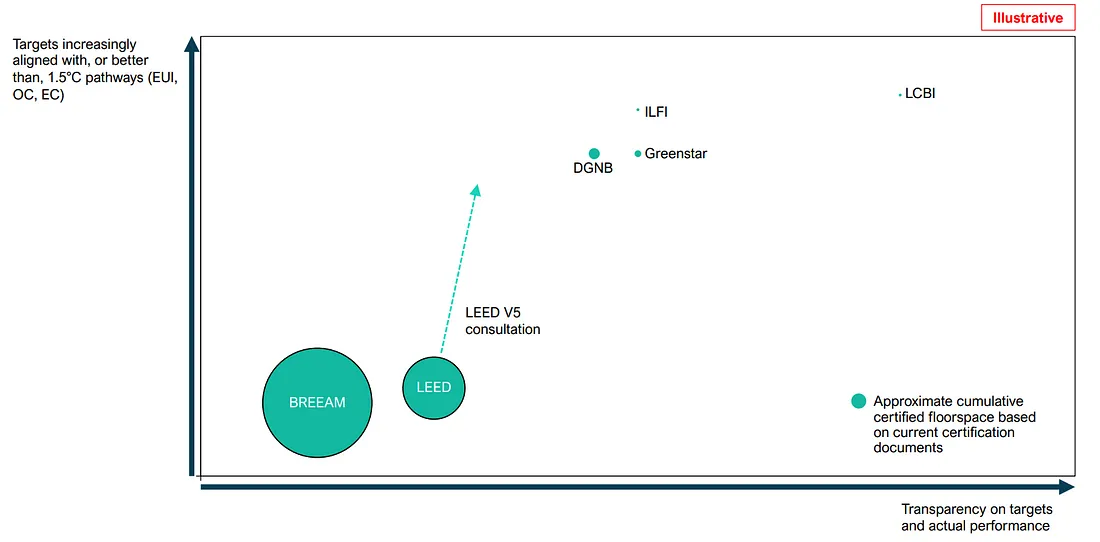

In actuality, according to our analysis, the major certifications, which account for an estimated 80% (or 9 billion m2) of worldwide certified floorspace, neither clearly define targets that are at least 1.5°C aligned nor provide transparency on carbon and energy performance as of yet (see Exhibit 4).

Exhibit 4: Illustration by Leaders of the Urban Future (LOTUF) in partnership with Systemiq showing major certifications LEED and BREEAM — covering an estimated 80% of certified floorspace — today provide limited transparency on carbon and energy performance and do not have clear targets that are broadly 1.5°C-aligned or better. Note: This only includes active certifications. Excludes portfolio ratings (GRESB) and energy ratings such as NABERS, EnergyStar, and EPCs.

With $7.2 trillion in assets under its belt, GRESB is the leading “green” portfolio rating in the market. It is performance-based and gives subscription LPs access to underlying carbon and energy indicators. Nevertheless, just 4% of its score is allocated to carbon and energy performance targets, which are not yet based on 1.5°C pathways. Rather, the assessment is based on whether or not operational and EUI carbon have improved year over year; upfront embodied carbon is not yet taken into account.

For end users making decisions about the risk and opportunity of the climate transition, schemes are useless indicators in the absence of transparent performance information and well-defined, broadly 1.5°C aligned targets.

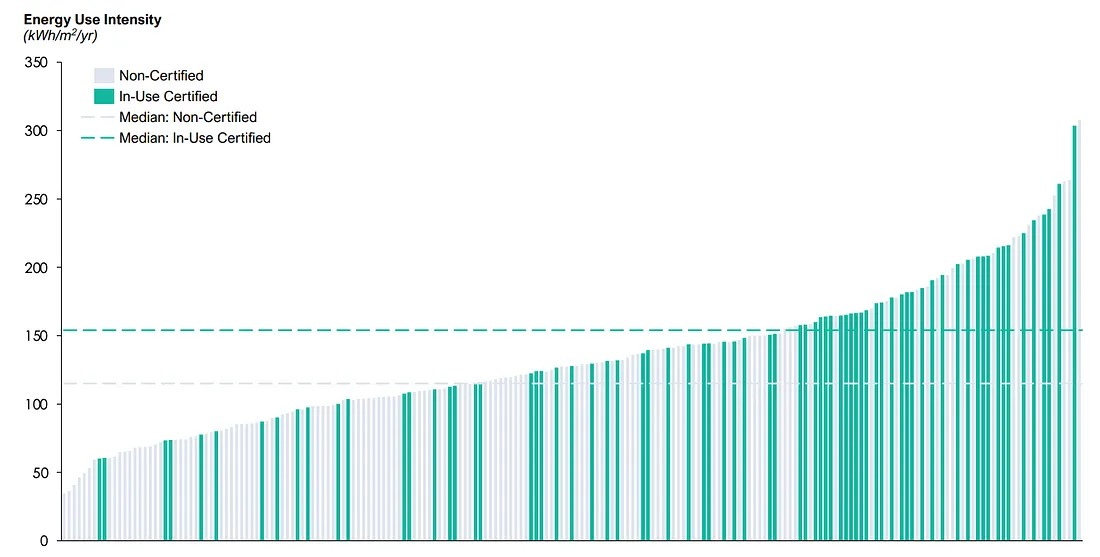

The energy use intensity (EUI) of several hundred office buildings throughout LOTUF portfolios was examined to provide more proof of this.

No correlation between certifications and energy performance (and by association carbon performance). See Exhibit 5 below.

Exhibit 5: Illustration by Leaders of the Urban Future (LOTUF) in partnership with Systemiq showing no correlation between certifications and energy performance

No correlation between certifications and 1.5°C pathway alignment37 (using CRREM pathways, which are increasingly emerging as a key target setting and benchmarking tool for real estate investors). See Exhibit 6 below.

hibit 6: Illustration by Leaders of the Urban Future (LOTUF) in partnership with Systemiq showing no correlation between certifications/portfolio ratings and 1.5°C pathway alignment

Note: To calculate CRREM alignment across datasets, each asset was compared to its relevant country and asset-specific CRREM EUI intensity pathway. Certifications in the office dataset include LEED, BREEAM, DGNB, BOMA/BEST and others. GRESB scores in the GRESB analysis only include 1-star, 2-star and 4-star.

Note: To calculate CRREM alignment across datasets, each asset was compared to its relevant country and asset-specific CRREM EUI intensity pathway. Certifications in the office dataset include LEED, BREEAM, DGNB, BOMA/BEST and others. GRESB scores in the GRESB analysis only include 1-star, 2-star and 4-star.

Additional evidence for these conclusions comes from analyses of EPC ratings from BBP39, major green certifications from JLL, and the Climate Bonds Initiative.

Of course, we acknowledge that many green certifications were initially intended to evaluate a variety of (important) sustainability indicators, including waste, water, and air quality, rather than only climate performance.42 Additionally, they have historically had a major positive influence on the real estate industry’s agenda by bringing up carbon and other sustainability-related issues. But since then, the market has evolved, and it is now imperative that carbon and energy performance be transparent.

While certifications and ratings are a response to market demand, they are not the primary source of this gap. End users who are concerned about carbon should push for 1.5°C alignment and increased transparency on carbon performance in order to bring about change. These demand signals are starting to show up, for example through organizations like LOTUF.

Additionally, we are starting to witness initiatives by key certifying bodies and rating agencies to enhance openness on goals and aspirations related to decarbonization, including taking 1.5°C pathways into account. The next BREEAM v7 and LEED v5, scheduled for launch in 2024 and 2025, respectively, are now undergoing consultation and development. These versions will feature more demanding performance targets and stronger data requirements. For instance, LEED v5 tightens the standards for both the in-use “zero carbon” badge and the highest “platinum” performance level. The new “zero carbon” designation places requirements on buildings to be at least “gold” certified, extremely energy-efficient, free of on-site combustion, and 1.5°C aligned overall by using 100% generated or bought renewable energy.

The real estate owners’ consent is one of the issues that both schemes have mentioned when it comes to publicly revealing the actual performance of certified assets (energy use intensity, operational carbon, and embedded carbon). Refer to Exhibit 3 for additional details. As stated in its 2024 roadmap, GRESB is also investigating ways to more effectively incorporate embodied carbon for new developments and acknowledges the need to better reward actual energy and operational carbon performance in its next edition.

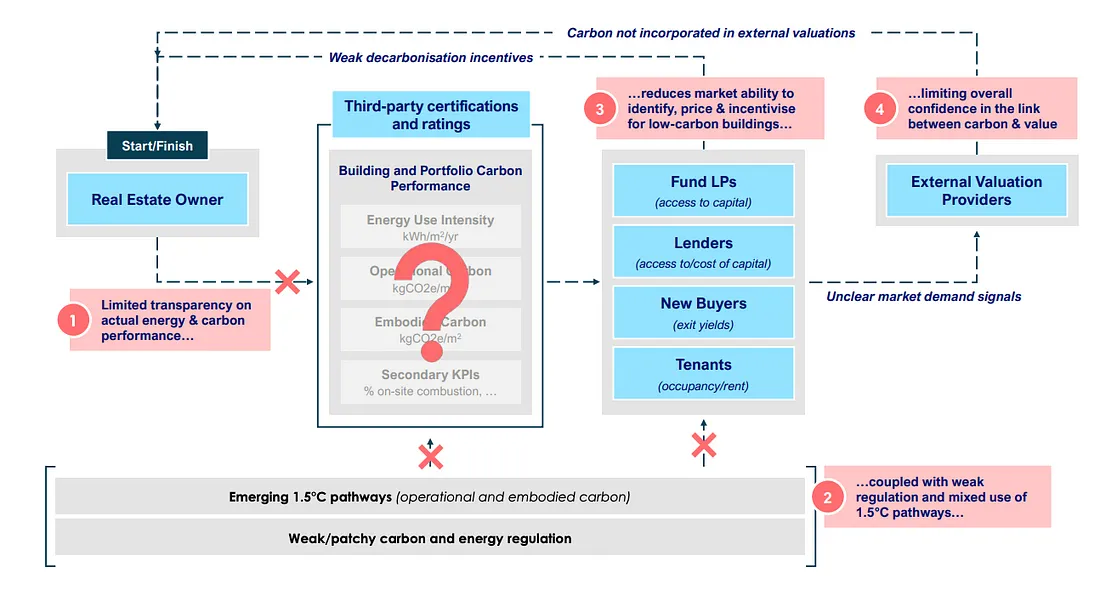

The market for low-carbon buildings is being muted by the lack of transparency and defined targets based on 1.5°C pathways, which is reducing owner confidence to invest in decarbonization.

The market for low-carbon buildings is being muted by the lack of transparency and defined targets based on 1.5°C pathways, which is reducing owner confidence to invest in decarbonization.

Due to the mentioned factors, it is becoming more difficult for lenders, renters, investors, and fund managers to find low-carbon buildings when they are trying to de-risk their operations or offer them as a value proposition. This is muting demand signals. Conversely, external valuation providers are unconfident about including a price for carbon in their evaluations. This implies that it is very difficult to establish a direct relationship between value and carbon.

The ultimate result is a lack of confidence on the part of real estate owners to invest in thorough decarbonization throughout their portfolios and assets, given their mandates to create and preserve wealth. Additionally, this structure restricts accountability for sluggish workers who might postpone taking action by exploiting the lack of transparency. Exhibit 7 illustrates this current configuration.

Exhibit 7: Illustration by Leaders of the Urban Future (LOTUF) in partnership with Systemiq showing the market is not yet providing the transparency on building and portfolio carbon performance vs. 1.5°C needed to unlock low-carbon real estate

Kick-Starting the Low-Carbon Real Estate Market

To ignite the low-carbon real estate market, the following actions are essential:

Demand for Transparency:

Lenders, tenants, investors, and fund managers must demand carbon and energy performance transparency from market participants and the certifications and ratings they utilize. Assessments should be based on common metrics, decarbonisation principles, and 1.5°C pathways.

Enhanced Certifications and Ratings:

Certifications and ratings should provide transparent targets, align with 1.5°C pathways, and publicly report on carbon and energy performance for rated buildings and portfolios.

Standard-Setters and Pathway Developers:

Align around common 1.5°C pathways to inform target setting, improving existing pathways. This multi-stakeholder effort involves standards, pathway developers, certifications, ratings, and national bodies like Green Building Councils. Developing embodied carbon pathways should be pursued in parallel with operational pathways.

External Valuation Providers:

Incorporate carbon into assessments by working with building owners and lenders to collect evidence on the carbon-value relationship, facilitating an emerging demand signal.

Policymakers:

Introduce ambitious performance-based regulations with clear targets for energy use intensity, operational carbon, and embodied carbon. These regulations should align with standards and pathways supporting the voluntary market, driving sector-wide progress.

Role of Real Estate Owners

Short-term Actions

1. Demonstrate the need for low-carbon buildings to lenders, tenants, and investors.

2. Use transparent certifications and ratings reflecting 1.5°C ambition.

3. Gather and share carbon and energy performance data, demanding the same during transactions.

4. Advocate for simple, ambitious, performance-based regulations with clear carbon and energy targets.

This call for greater transparency is supported by initiatives like GREEN and the Better Buildings Partnership (BBP). A simple due diligence framework is provided to aid stakeholders in assessing carbon performance using available tools (see Appendix). LOTUF has been working to increase the transparency and ambition of major certifications and ratings like LEED and BREEAM, with positive market responses.

Progress and Future Needs

Market Developments

LEED and BREEAM are updating schemes for greater transparency and ambition.

New carbon-focused schemes like LCBI are emerging.

Efforts to improve CRREM 1.5°C pathways and drive industry uptake continue.

RICS published guidance on incorporating carbon and energy into valuations.

Greater transparency in carbon and energy performance and alignment with 1.5°C pathways are essential to linking carbon and value, unlocking the low-carbon real estate market. Nearly 20% of current real estate value is at risk from inaction, but decarbonisation can create value. Real estate owners and market participants must shift from opaque tools to transparent carbon performance and 1.5°C targets. An emerging toolkit of data and pathways can facilitate this shift, requiring continuous improvement but serving as a solid starting point for accelerating change today.

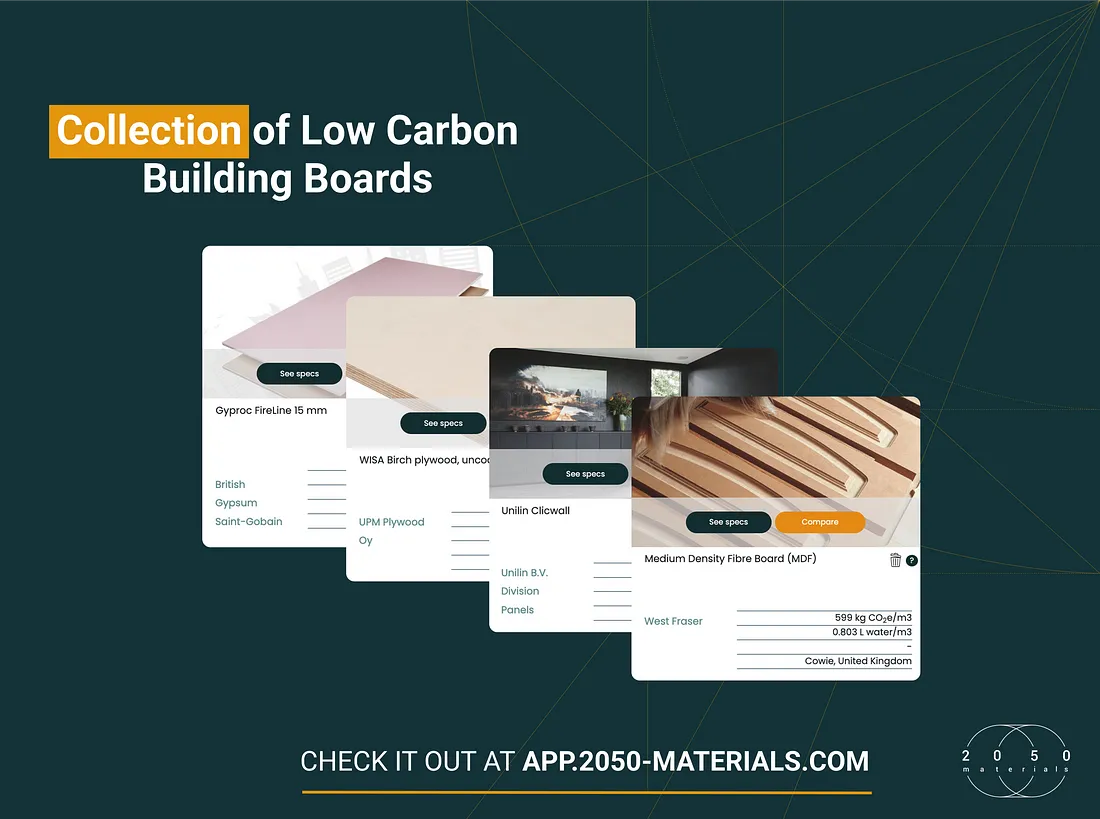

2050 Materials’ Role in Creating a Low-Carbon Market for Real Estate

Greater transparency in carbon and energy performance and alignment with 1.5°C pathways are crucial for linking carbon and value and unlocking the low-carbon real estate market. With nearly 20% of current real estate value at risk from inaction, decarbonisation can create and preserve value. Real estate owners and market participants must shift to transparent tools like 2050 Materials that provide a vast library of building materials based on their sustainability features, enabling the construction industry and real estate market to make data-driven decisions at any project stage.

The platform hosts over 100,000 products populated with sustainability data from EPDs and other certifications and offer an easy to use comparison feature to objectively compare product sustainability.

Illustration of the 2050 Materials platform

Sources

Seeing is Believing: Unlocking the Low-Carbon Real Estate Market — Leaders of the Urban Future (LOTUF) in partnership with Systemiq

The Buildings Eligibility Criteria of the Climate Bonds Standard & Certification Scheme — Climate Bonds

Net Zero Carbon Pathway Framewor — BBP Climate Commitment

Net Zero Roadmap A Global Pathway to Keep the 1.5 °C Goal in Reach — IEA

LaSalle global real estate universe — summary — LaSalle

Related articles

Climate-Resilient Materials for the Built Environment: A Data-Centred Prime

As climate volatility intensifies, resilience metrics are fast becoming as critical as carbon data in material selection. This article outlines why adaptation is now a design imperative, how materials can be evaluated through a systems lens, and what KPIs project teams should demand. From self-healing concrete to fire-rated façades, we present a structured taxonomy of resilient materials, explain how to embed this intelligence into digital design workflows, and propose next steps for specification, benchmarking, and procurement.

Read more

The Most Interesting Low Carbon Products in Office Design

In this article and collection, we highlight 11 outstanding products that contribute to a lower carbon footprint in office design.

Read more

Top Low Carbon Building Boards: Performance, Benefits, and Use Cases

The building boards highlighted in this article and collection showcase low-carbon innovation in modern construction.

Read more